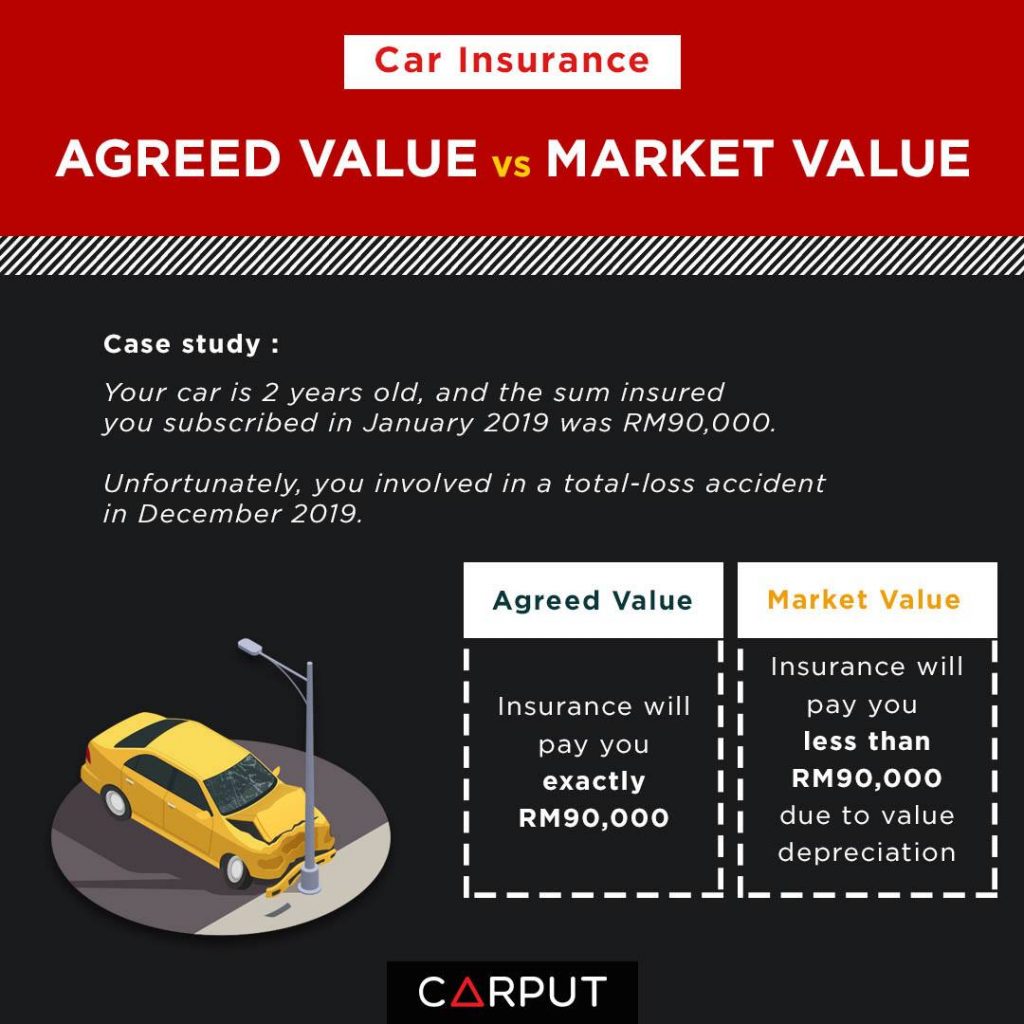

Before renewing your car’s road tax, did you ever enquire about the insurance’s type of sum insured?

If you did not know before, there are two types of sum insured for your car; Agreed Value or Market Value.

So, what’s the difference between them?

Besides selecting first party or 3rd party insurance coverage, you should also know the importance of agreed/market value.

In this blog, we will explain why choosing the right type of sum insured will benefit you.

Understand the Value of Your Car

The value of a car depreciates around 10-15% every year. While some cars depreciates faster over the years, what does entail for that car insurance’s sum insured?

Here’s the scenario.

The insurance’s sum insured is meant to help car owners in the event of a total-loss accident. If the car is totally paid up, the insurance money can be used to purchase a new car. However, if the car is still owed to the bank, the money can be used to pay off the balance of the debt.

Hence, the car’s sum insured should be more than the debt amount owed to the bank.

Market Value Insurance Calculations

Market Value Insurance = Based on the current market value of the car at that point in time when an insurance claim is made

Market value insurance calculation example:

Your car’s market value is RM90,000 when you bought the insurance. 11 months down the road, the car’s value might drop to RM75,000. The market value sum insured will only cover you up to RM75,000 which is equivalent to how much the market perceive your car is worth.

Here’s the problem.

When a car owner still have a high debt balance, for example RM85,000 owed to the bank. The remaining RM10,000 will have to come out of the owner’s own pocket to cover the balance.

Vehicle debt balance: RM85,000

Insurance claim: RM75,000

Debt balance: RM10,000

Insufficient sum insured against vehicle debt simply means you lose. You’ve lost your car but the debt remains.

Agreed Value Insurance Calculations

Agreed Value Insurance: Based on the agreed value of the car when the insurance is purchased

Agreed Value Insurance calculation example:

Vehicle debt balance: RM85,000

Insurance claim: RM90,000

Debt balance: RM0

In this case, you will have an additional Rm5,000 after settling the bank debt.

So, which type of sum insured is better for you? It’s pretty simple.

Agreed Value Insurance = For new cars that still owe a large sum of debt to the bank

Market Value Insurance = For older cars and no longer owe the bank anything